How to Measure Your Net Worth the Simple Way

What is net worth?

Net worth is the value of your assets minus your liabilities.

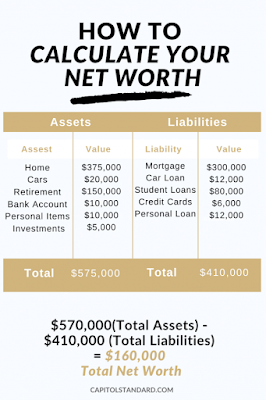

Assets are the things that you own that have monetary value, such as cash, bank accounts, investments, retirement accounts, real estate, vehicles, jewelry, art, etc.Liabilities are the debts that you owe to others, such as mortgages, car loans, student loans, credit card balances, medical bills, taxes, etc.

Net worth is a snapshot of your current financial situation and progress. It can help you track your wealth over time, set financial goals, plan for retirement, and more. It can also help you compare your financial standing with others.

How to calculate net worth?

To calculate your net worth, you need to follow these steps:

List all your assets.

Add up the current market value or the estimated resale value of all the things that you own that have monetary value. You can use online tools or appraisals to help you with this step.

List all your liabilities.

Add up the current outstanding balance or the payoff amount of all the debts that you owe to others. You can use online tools or statements to help you with this step.

Subtract your total liabilities from your total assets.

This is your net worth. If the result is positive, it means you have more assets than liabilities. If the result is negative, it means you have more liabilities than assets.

You can use our net worth calculator to help you with this process. You can also check out some of the web search results I provided below for more information and tips on how to calculate and increase your net worth.

How to improve net worth?

increase your assets or decrease your liabilities.

Here are some examples of how to do that:

1. Increase your income by working more hours, getting a raise, finding a new job, starting a side hustle, etc.

2. Save more money by creating a budget, cutting expenses, automating savings, building an emergency fund, etc.

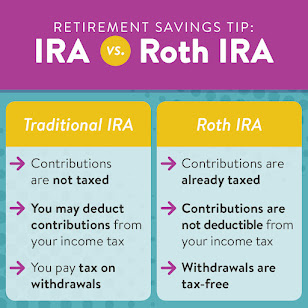

3. Invest more money by opening a retirement account, contributing to a 401(k), buying stocks and bonds, diversifying your portfolio, etc.

4. Pay off debt by making extra payments, refinancing loans, consolidating debt, negotiating lower interest rates, etc.

5. Increase the value of your assets by maintaining and improving your home, car, or other similar assets; selling unwanted or unused items; buying appreciating assets; etc.6. Decrease the value of your liabilities by avoiding new debt; paying off high-interest debt first; using cash instead of credit cards; etc.

Improving your net worth may take time and effort, but it is worth it in the long run. By measuring your net worth regularly and taking steps to improve it, you can achieve financial freedom and security.

I hope this article helps you understand how to measure your net worth the simple way. If you have any questions or feedback, please let me know. I would love to hear from you! 😊

Learn more:

1. businessinsider.com 2. nerdwallet.com 3. investopedia.com

4. wealthsimple.com 5. moneycrashers.com

Comments

Post a Comment